INTRODUCTION OF SERVICE TAX

Service tax is an example of an indirect tax that applies when you sell or purchase any service.

It consisted of (Income tax, Education Cess, and Secondary education cess.)

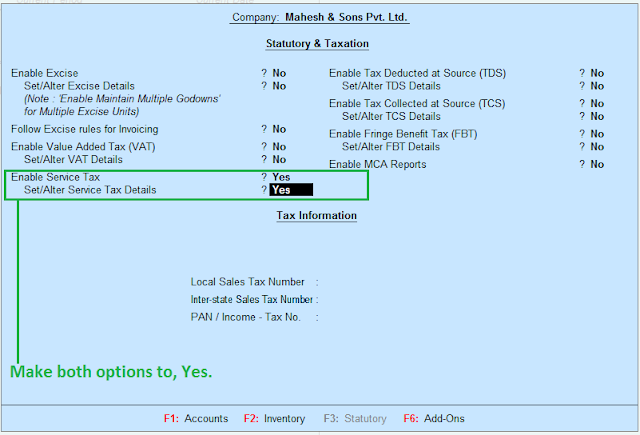

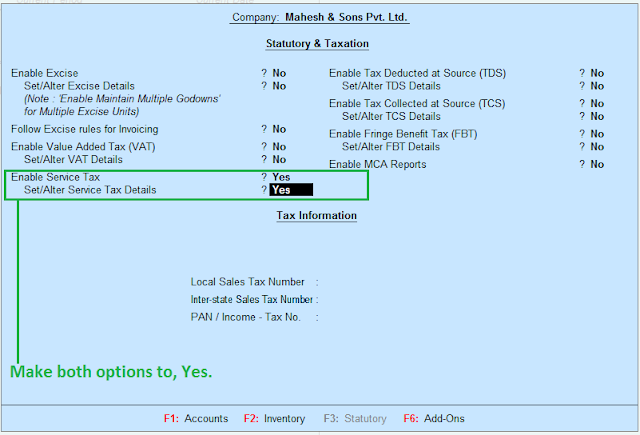

STEPS TO ENABLE SERVICE TAX

1. Create or open an already existing company.

2. Press “F11” key.

3. Select “Statutory & Taxation”

4. Now make yes to “Enable Service Tax” and “Set/Alter Service Tax Details”

LEDGERS FOR SERVICE TAX

To implement service tax, we need/require the following ledgers.

2. Press “F11” key.

3. Select “Statutory & Taxation”

4. Now make yes to “Enable Service Tax” and “Set/Alter Service Tax Details”

LEDGERS FOR SERVICE TAX

To implement service tax, we need/require the following ledgers.

SALES LEDGER

Ledger name: Sales (Maintenance) a/c

Under: Sales Accounts

Is service tax applicable: Yes

Category name: Maintenance Or Repair Service

TAX LEDGERS

There three tax ledgers, which applies to every service tax transaction.

SERVICE TAX A/C

Ledger name: Service Tax a/c

Under: Duties & Taxes

Type of Duty/Tax: Service Tax

Tax Head: Service Tax

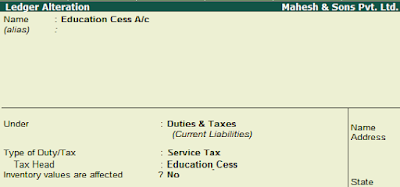

EDUCATION CESS TAX A/C

Ledger name: Education Cess A/c

Under: Duties & Taxes

Type of Duty/Tax: Service Tax

Tax Head: Education Cess

SEC. EDUCATION TAX A/C

Ledger name: Secondary Education Cess A/c

Under: Duties & Taxes

Type of Duty/Tax: Service Tax

Tax Head: Secondary Education Cess

SERVICE TAX VOUCHER ENTRY

To insert service tax sales and purchase entries, we also use Sales and Purchase voucher but in a different mode.

Actually, sales and purchase voucher can be used in the following two different modes, which are described below.

1. Item invoice: This format is used for sales and purchase (Stock items).

2. Account invoice: This format is used for sales and purchase (Services)

SERVICE TAX VOUCHER ENTRY STEPS

Step 1. Open an already existing company.

1. Item invoice: This format is used for sales and purchase (Stock items).

2. Account invoice: This format is used for sales and purchase (Services)

SERVICE TAX VOUCHER ENTRY STEPS

Step 1. Open an already existing company.

Step 3. Click on “Accounting voucher”

Step 4. Click on “Sales” voucher or press “F8”

Company name: Dream Technical Solution Pvt. Ltd.

Ledger Entries

Opening balance Rs. 14,50,000

Bank A/c (Amount Rs. 18,00,000)

Machinery A/c (Amount Rs. 1,20,000)

Voucher Entries

1. Sold (Maintenance Service) for cash Rs. 12,000 to Shubham Computers with service tax.

1. Sold (Maintenance Service) for cash Rs. 12,000 to Shubham Computers with service tax.

2. Paid office Rent to Mahesh Properties, Rs. 1,85,000 by cheque with TDS.

3. Sold (Repair service) for cash Rs. 15,000 to Dinesh electronics with service tax.

4. Sold (Application Software) for Cash Rs. 40,000 to Aptech computer education.

Service tax group (Information technology software services)

5. Sold (AMC Service) for cash Rs. 45,000 to NIIT.

Service tax group (Information technology software services)

6. Depreciation 7% on machinery.

I really liked your Information. Keep up the good work. Desentupidora em Suzano

ReplyDelete