INTRODUCTION OF TDS

TDS stands for "Tax Deducted at Source"

Its an example of 'Direct tax', that is applied to different types of incomes, therefore it's also an example of income tax.

TDS INCOME EXAMPLES

Interest on securities, Debentures

Interest other than interest on securities

Winnings from Lottery or Crossword Puzzles

Winnings from horse races

Insurance Commission

Commission etc. on the sale of Lottery tickets

Commission, brokerage etc

Rent of Land, Building or Furniture

Rent of Plant, Machinery or Equipment

Fees for professional or technical services

So on...

FEATURES OF TDS

1. TDS is an example of direct tax because it's a type of income tax.

2. Its apply on certain types of incomes with a required minimum amount.

3. It consisted of (Income Tax, Surcharge, Education Cess, Sec. Education Cess).

1. TDS is an example of direct tax because it's a type of income tax.

2. Its apply on certain types of incomes with a required minimum amount.

3. It consisted of (Income Tax, Surcharge, Education Cess, Sec. Education Cess).

TDS COMPONENTS

What is TAN?TAN stands for 'Tax Deduction Account Number' and its issue by Income-tax Department to all persons, who deducting tax at source. TAN has to be mentioned in all relevant challans, tax deduction certificates, TDS returns and other notified documents.

Who has to Deduct Tax?

Any person making the payments to third parties as specified in scope and applicability section are required to deduct tax at source.

Who is a Deductee?

As per Income Tax Act, the Tax will be deducted at source based on the prescribed rate on payments made to the third parties, who are Assessees (includes individual & HUF as covered U/S 44AB) carrying on the business of following types.

Such Tax will be deducted at time of payment or credit whichever is earlier.

Individual

Hindu Undivided Family (HUF)

Body of Individual

Association of person

Co-Operative society

Local Authority

Partnership firm

Domestic company (Indian company)

Foreign company

Artificial Judicial Person

To Enable TDS in Tally ERP 9, we have to follow these steps.

1. Open an already existing company.

2. Press “F11” key.

3. Select the “Statutory & Taxation” from the “Company feature”

4. Make “yes” to Enable TDS: the following options.

TDS LEDGERS

EXPENSE LEDGER

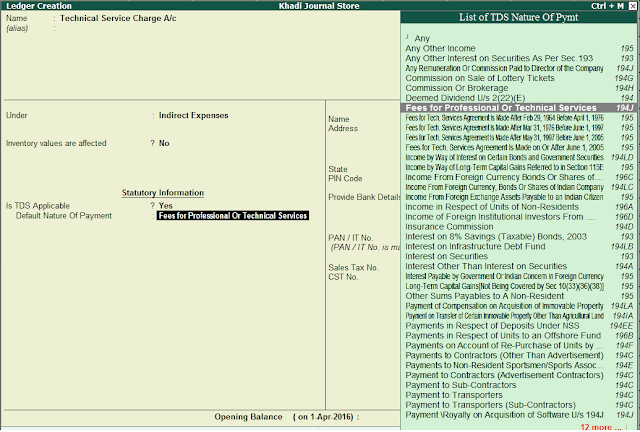

Ledger name: Technical Service Charges A/cGroup name: Indirect Expenses

TDS EXERCISE

Ledger Entries

2. Purchase goods by cash (100 Pen drive) with 5% discount

3. Paid commission Amount Rs. 7,500 with TDS To Mr. Sunil

4. Paid Technical service charges Rs. 40,000 with TDS to Dinesh IT solution

5. Sold goods for cash (4 DVD player) with 2% discount.

6. Depreciation 2% on old furniture (Total value amount Rs. 25,000)

7. Withdraw Cash Rs. 7,00,000 from bank to office use.

8. Newspaper expense charges Rs. 500

9. Depreciation 4% on machinery

10. Repair old machinery charges Rs. 7,000

11. Withdraw Cash Rs. 15,000 from bank to personal use.

12. Paid office Rent (Amount Rs. 1,85,000) with TDS to Mr. Amit

HOW TO ENABLE TDS

To Enable TDS in Tally ERP 9, we have to follow these steps.

1. Open an already existing company.

2. Press “F11” key.

3. Select the “Statutory & Taxation” from the “Company feature”

TDS LEDGERS

To implement TDS we need at-least three ledgers for each TDS transaction.

EXPENSE LEDGER

Ledger name: Technical Service Charges A/cGroup name: Indirect Expenses

Is TDS Applicable: Yes

Default nature of payment: Fee for professional or Technical services.

CREDITOR LEDGER

Ledger name: Dream Tech. Solution

Group name: Sundry creditor

Maintain balances bill by bill: No

Is TDS Deductable: Yes

Deductee type: Company-Resident

TAX LEDGER

Ledger name: TDS (Technical service) A/c

Group: Duties & taxes

Type Duty/Tax: TDS

Nature of payment: Fee for professional or Technical services.

HOW TO TDS REPORT

1. Enable TDS feature

2. Click on “Display” Menu

Default nature of payment: Fee for professional or Technical services.

CREDITOR LEDGER

Ledger name: Dream Tech. Solution

Group name: Sundry creditor

Maintain balances bill by bill: No

Is TDS Deductable: Yes

Deductee type: Company-Resident

TAX LEDGER

Ledger name: TDS (Technical service) A/c

Group: Duties & taxes

Type Duty/Tax: TDS

Nature of payment: Fee for professional or Technical services.

HOW TO TDS REPORT

1. Enable TDS feature

2. Click on “Display” Menu

3. Click on “Statutory Info.”

4. Make yes to “Enable Tax Deducted at Source (TDS)” & “Set/Alter TDS Details”

4. Make yes to “Enable Tax Deducted at Source (TDS)” & “Set/Alter TDS Details”

TDS EXERCISE

Company name: ABC Electronics

Inventory Details

Inventory Details

Stock items

|

Brand

|

Quantity

|

Stock price

|

Sales price

|

Pen drive

|

Scan disk

|

400

|

250

|

300

|

Refrigerator

|

LG

|

50

|

20,000

|

22,000

|

Radio

|

Phillips

|

150

|

2,500

|

3,500

|

DVD Player

|

Phillips

|

140

|

4,000

|

4,500

|

Ledger Entries

Opening balance Rs. 7,50,000

Cash in bank Rs. 16,50,000

Machinery Amt. Rs. 75,000

Voucher Entries

1. Purchase goods (15 DVD Player, 40 Radio) by cash with 2% discount.

2. Purchase goods by cash (100 Pen drive) with 5% discount

3. Paid commission Amount Rs. 7,500 with TDS To Mr. Sunil

4. Paid Technical service charges Rs. 40,000 with TDS to Dinesh IT solution

5. Sold goods for cash (4 DVD player) with 2% discount.

6. Depreciation 2% on old furniture (Total value amount Rs. 25,000)

7. Withdraw Cash Rs. 7,00,000 from bank to office use.

8. Newspaper expense charges Rs. 500

9. Depreciation 4% on machinery

10. Repair old machinery charges Rs. 7,000

11. Withdraw Cash Rs. 15,000 from bank to personal use.

12. Paid office Rent (Amount Rs. 1,85,000) with TDS to Mr. Amit

Your blog is fantastic! What a brilliant idea to share such informative content with us. Thank you for generously sharing this valuable resource. This post about TDS Service Provider in Delhi is particularly insightful. If you're in need of a TDS service provider in Delhi, feel free to reach out to us today!

ReplyDelete